Metaplanet, the Tokyo-listed firm that has been shifting into a Bitcoin treasury role, moved this week to shore up its balance sheet and add more BTC to its vault.

The company cleared a plan to raise up to about $137 million through a mix of new shares and stock acquisition rights aimed at buying Bitcoin, supporting its income business tied to BTC, and cutting some debt.

Reports say the fundraising will be done mainly with select overseas investors rather than a public share sale.

Metaplanet’s Capital Mix

According to filings, Metaplanet plans to issue 24.53 million new common shares at 499 yen apiece, which would bring in roughly 12.24 billion yen immediately.

In addition, the company will grant stock acquisition rights that could raise more money if exercised, taking the total potential haul to about 21 billion yen (roughly $137 million).

Reports note the share price for the offering sits a little above recent trading levels, but investors still reacted nervously.

In a filing Thursday, Metaplanet announced it will offer 24.5 million common shares, each priced at 499 JPY.

A Push To Buy More Bitcoin

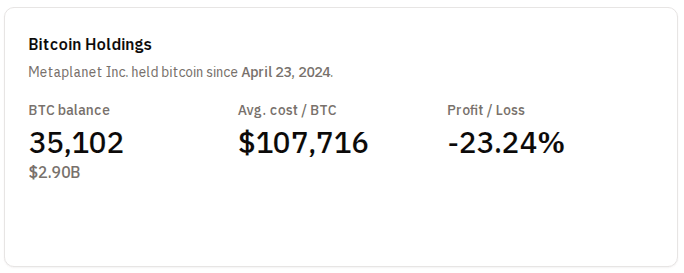

Metaplanet has been piling up BTC for a while. As of late December 2025, the company held about 35,102 Bitcoin, based on public updates.

The new funds are meant to let it keep buying while also giving breathing room for its Bitcoin income operations — those are businesses that try to earn fees or returns from BTC activity rather than from hotels or other old lines of business. Some of the cash will also go toward paying down borrowings tied to its recent credit facility.

Metaplanet's current Bitcoin holdings. Source: Bitcoin Treasuries

Market Response And Risks

Stock traders pushed Metaplanet shares lower after the news, with the price slipping several percent during the session on concerns over dilution and the short-term impact of the issuance.

The company has faced sharp swings before: it booked a large non-cash impairment late in 2025 after Bitcoin’s fall, a hit that trimmed reported equity by a big sum and highlighted how tied the firm is to BTC prices. That accounting loss does not mean the coins were sold, but it did spook some investors.

Why This Matters

Reports say Metaplanet is trying to balance growth of its Bitcoin stash with steps to make its finances less fragile. The move shows a bet that holding more BTC and building services around it can pay off, but the plan also exposes shareholders to more swings in crypto markets.

For some investors, the chance to back a focused Bitcoin treasury is attractive. For others, the same bet looks risky, especially when big paper losses can show up on financial statements even while the firm holds the same coins.

Featured image from Unsplash, chart from TradingView